GST Reforms Make Travel More Affordable, Premium Experiences Costlier

India’s latest Goods and Services Tax (GST) reforms are set to reshape the travel and tourism landscape by prioritizing affordability and wider accessibility.

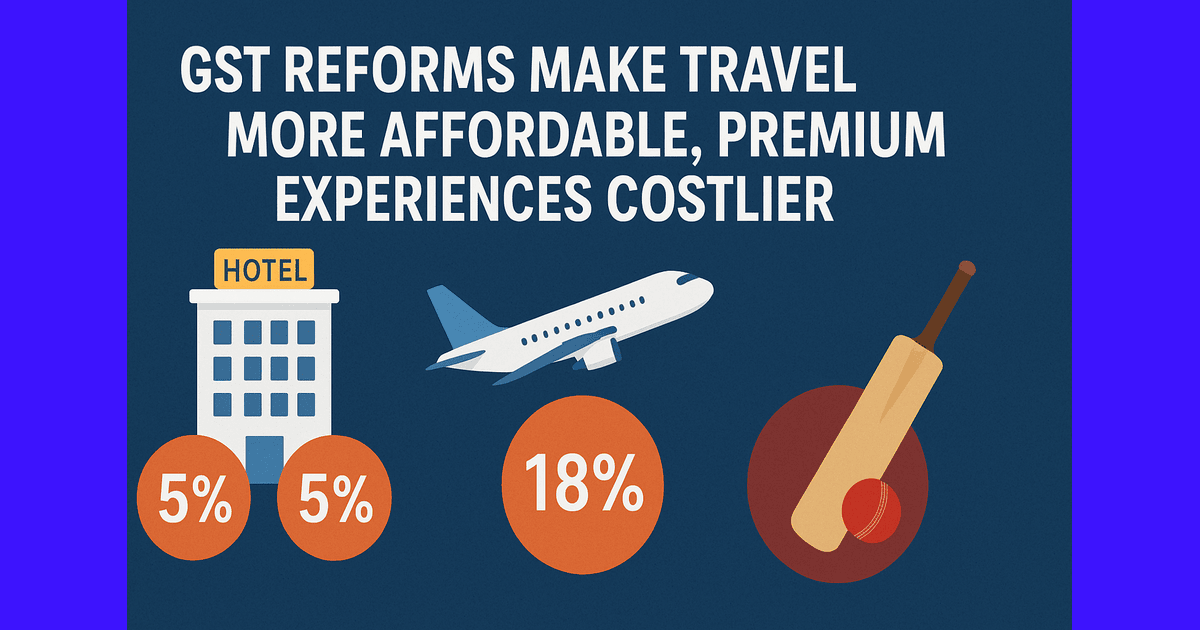

The GST Council has reduced the tax rate on hotel stays priced up to Rs 7,500 ($85) per night from 12% to 5%. Industry experts believe this will make mid-range accommodations more attractive to domestic travelers, who form the bulk of India’s tourism market. With rising demand for budget and mid-segment hotels, the lower levy is expected to boost occupancy rates and stimulate travel to tier-2 and tier-3 destinations.

Air travel sees a more mixed outcome. Economy class tickets will continue to attract a 5% GST, ensuring no additional burden for mass travelers. However, GST on non-economy cabin classes has been hiked from 12% to 18%, signaling the government’s intent to discourage subsidies on premium travel. This shift aligns with India’s broader taxation philosophy—keeping essential services affordable while taxing luxury consumption at higher rates.

Entertainment and leisure, particularly casinos, race clubs, and high-profile sporting events like the Indian Premier League (IPL), will now face a 40% GST, up from the previous 28%. Analysts note this move could temper spending in luxury gaming and sports entertainment, while ensuring higher revenue collection from non-essential, high-spend segments.

Industry stakeholders have largely welcomed the reforms. Travel operators expect the reduced hotel tax and stable economy airfare levy to increase travel volumes, especially among the growing middle class. However, the hike in luxury-related taxes may impact premium hospitality, business travel, and upscale tourism experiences.

Overall, the reforms underscore the government’s effort to democratize travel by lowering barriers for everyday travelers, while ensuring luxury and high-value leisure experiences contribute more significantly to tax revenues.

Hon’ble Prime Minister Shri @narendramodi announced the Next-Generation GST Reforms in his Independence Day address from the ramparts of Red Fort.

— Nirmala Sitharaman Office (@nsitharamanoffc) September 3, 2025

Working on the same principle, the GST Council has approved significant reforms today.

These reforms have a multi-sectoral and… pic.twitter.com/NzvvVScKCF

Popular Categories

Read More Articles

Business

Why India’s Next Banking Crisis Won’t Start With Bad Loans by Malik Mubashir February 2, 2026Business

Budget 2026: Big Push for Orange Economy to Create 2 Million Skilled Professionals with ₹250 Cr for Animation Labs by Awadh 360° Desk February 1, 2026Business

'Union Budget 2026 reinforces India’s manufacturing ambitions': Entrepreneurs react to announcements by FinMin Nirmala Sitharaman by Awadh 360° Desk February 1, 2026Education

What is the UGC equity rule controversy that has triggered protests and resignations? by Awadh 360° Desk January 28, 2026